Description

Below are two links to two different models. The first models the wealth distribution of America using the current Estate Tax. The second models the wealth distribution of America using a high Estate Tax

Model without an high Estate Tax link

Model with an high Estate Tax link

To open up this model, you will need to have the latest version of the software Vensim. Opening up this link will download the Vensim file. After opening the model press the green play button on the top tool bar called SyntheSim. This will run the model. You can change parameters using the slider bars and observe how the graph changes.

How does it run on different scales?

Both Vensim models run exactly the same on different scales with different amounts of starting population values

What breaks the model?

To break the model I set some value to impossible values like changing the death rate to 0. Although the shape of the graph turned to be exponential, the gap between the different classes stayed the same for both models.

Parameters that can be changed

- Low_to_Up = 4.2%

- Low_to_Mid = 37%

- Mid_to_Up = 13.5%

- Mid_to_Low = 19%

- Up_to_Mid = 8%

- Up_to_Low = 1%

- Birth_Rate= 5%

- Death_Rate= 5%

What I learned

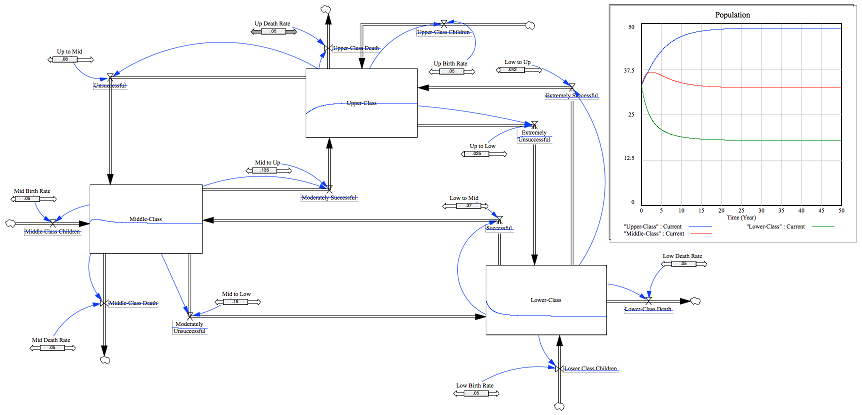

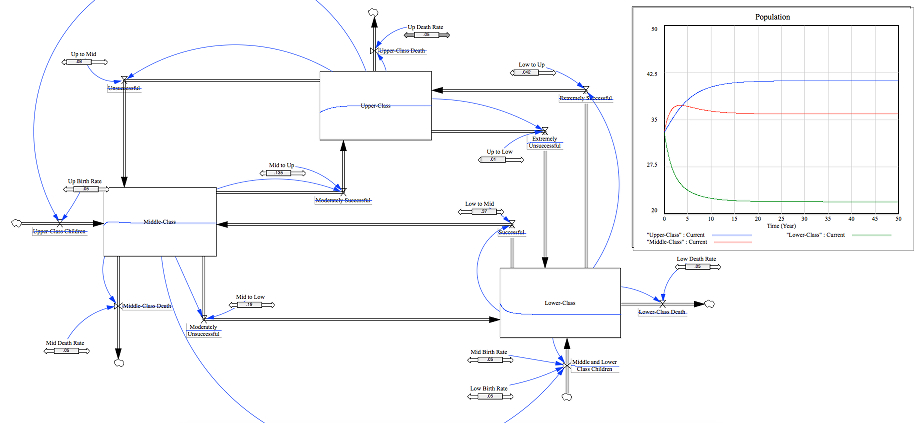

As demonstrated in the screenshots below, the model with a high estate tax has a much more even distribution of wealth compared to the model without a high estate tax. But while the gap is smaller, the model with a high estate tax still exhibits a gap in wealth. While this model cannot determine the cause of the gap, I hypothesis that the gap is caused by the percentages of people moving up and down the wealth ladder that favors moving up.

Model without a high Estate Tax

In this model there is a higher number of wealthy people but there is also a higher number of poor people. The gap between the two is also more than the next model. This makes sense as wealthy people create wealthy children and people from the middle and lower-classes have more of an opportunity to move up than down.

Model with a high Estate tax

In this model there is a lower number of wealthy people but there is also a lower number of poor people. The gap between the two is also less than the previous model. I also found that by increasing the percentages for people to move down, the distribution gap decreased as well.