Description

Below are two links to two different AgentCubes models. The first models the wealth distribution of America using the current Estate Tax. The second models the wealth distribution of America using a high Estate Tax. A High Estate is represented by the children of two people starting in a class lower than their parents

Model without an high Estate Tax link

Model with an high Estate Tax link

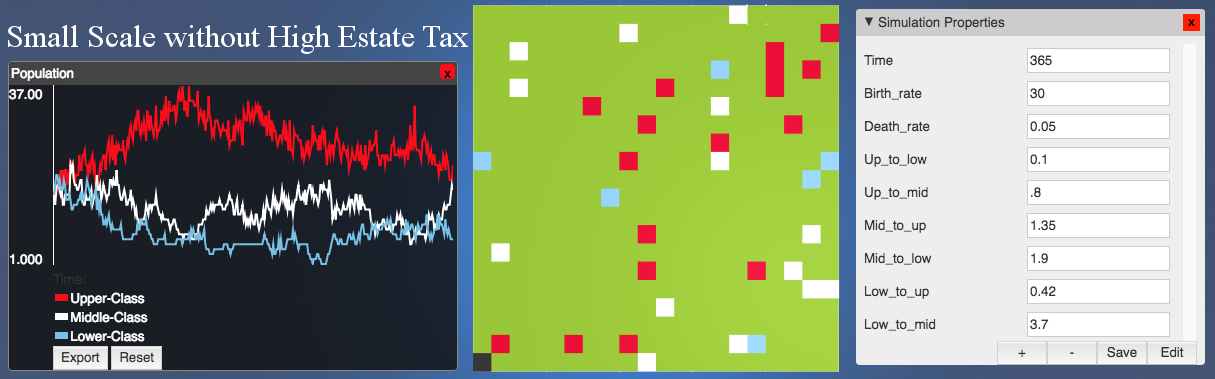

By clicking the links above, you will be taken to the AgentCubes website with my model. To run the model press the green play button at the top. You may also open up the simulation propreties by clicking the gear in the top left and then clicking "Show Simulation Properties. To run the model on different scales change the world by bar left of the refresh sign at the top.

Agents and Shapes

| Agent | Shape | Color |

|---|---|---|

| Person | Lower-Class | Blue |

| Person | Middle-Class | White |

| Person | Upper-Class | Red |

| World | Light Green | |

| Counter | Black |

Parameters that can be changed

- Low_to_Up = 4.2%

- Low_to_Mid = 37%

- Mid_to_Up = 13.5%

- Mid_to_Low = 19%

- Up_to_Mid = 8%

- Up_to_Low = 1%

- Birth_Rate= 5%

- Death_Rate= 5%

*Numbers in the AgenCubes model differ from the numbers above to account for the fact that Agents do no interact on every time step. But the numbers are scaled evenly so that the ratios above are represented in the model.

How does it run on different scales?

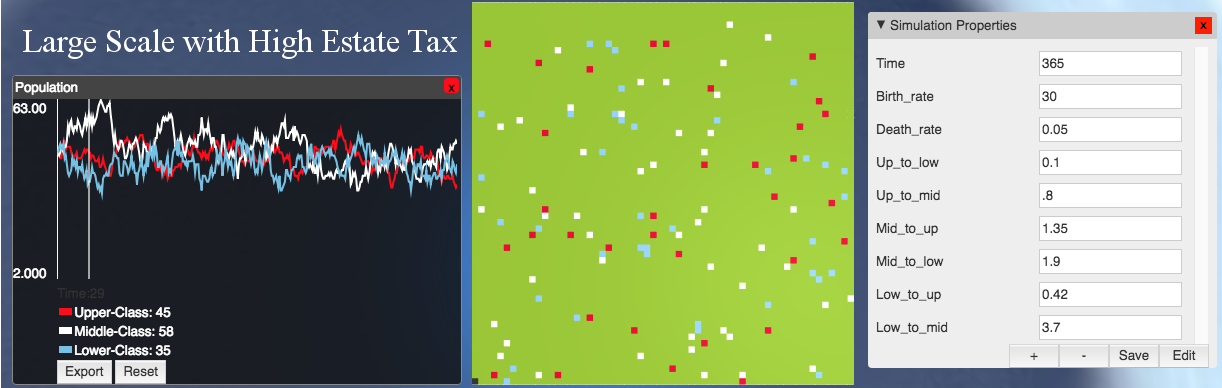

For the model with a high estate tax, as the scale increase the efficiency of the estate tax increase and the gap between the classes decrease. For the model with a high estate tax, the gap between the classes increase as the scale increase.

What breaks the model?

To break the model I set some value to impossible values like changing the death rate to 0. This caused the number of upper-class people to grow exponentially.

What I learned

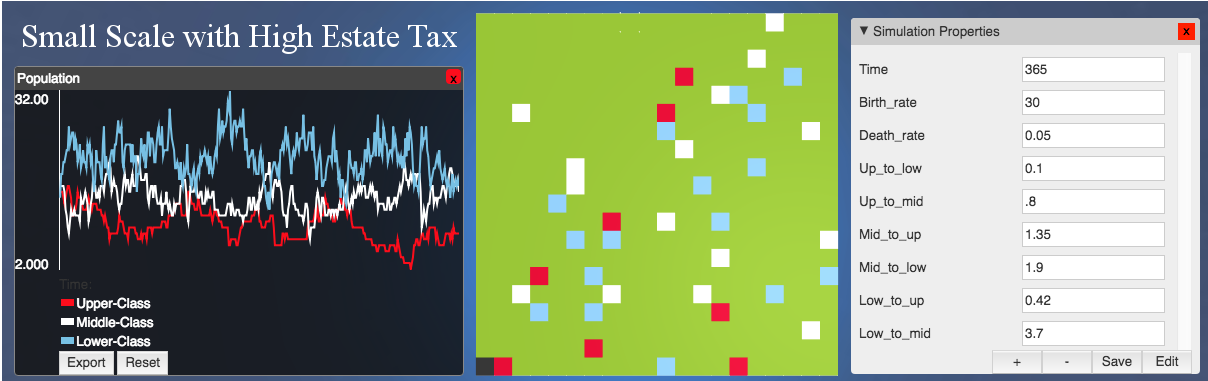

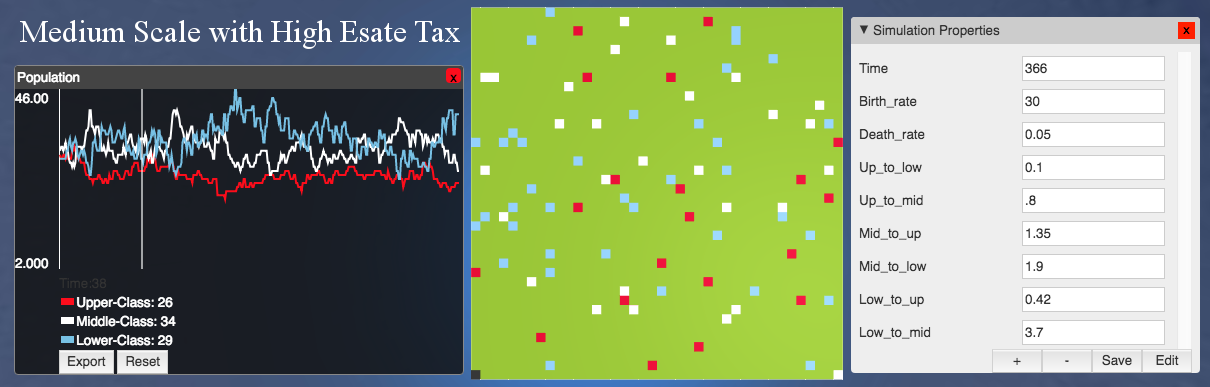

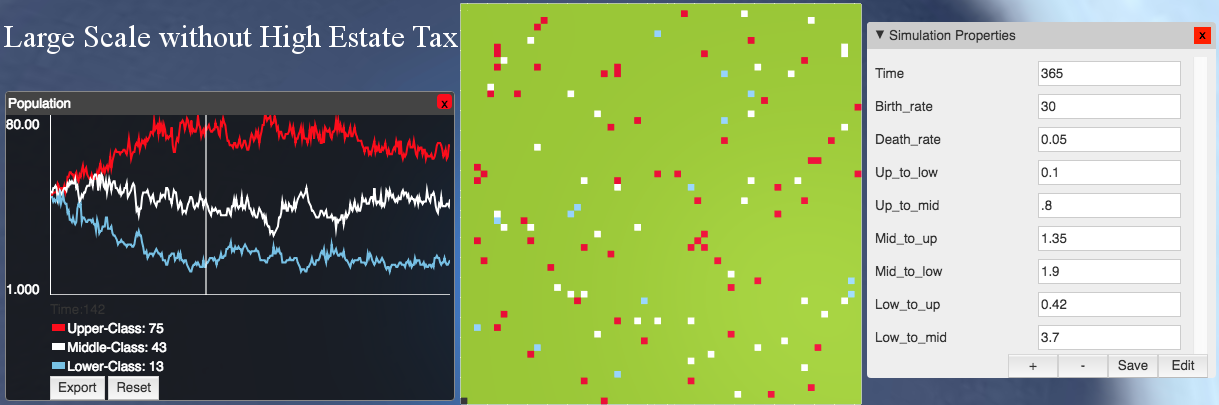

As demonstrated in the screenshots below, the model with a high estate tax has a much more even distribution of wealth compared to the model without a high estate tax. Although the model does not exhibit this on a smaller scale, it does so on the larger and more realistic scale. I also learned that the model without a high estate tax shows a large gap on the larger and more realistic scale.

Small, Medium, and Large base worlds

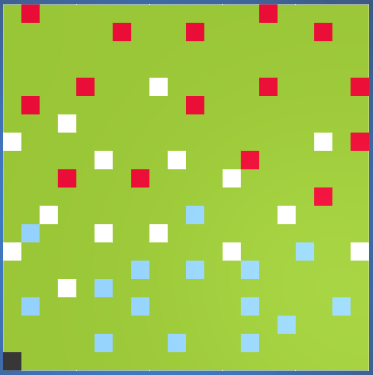

Small Scale

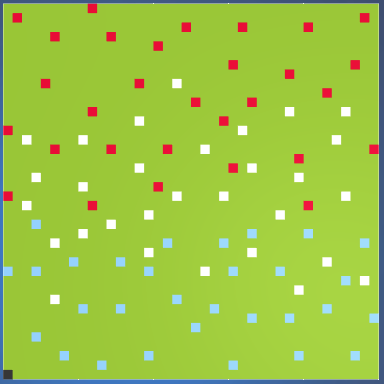

The picture on the top illustrates a world after 365 time steps (a year) without a high estate tax on a small scale. The wealth gap is large between the upper-class and the lower two classes. The picture on the bottom shows a medium scale world after a year with a high estate tax. The wealth distribution is more even than the top picture but a gap still exists. Additionally, there were more lower-class people than any other class.

Medium Scale

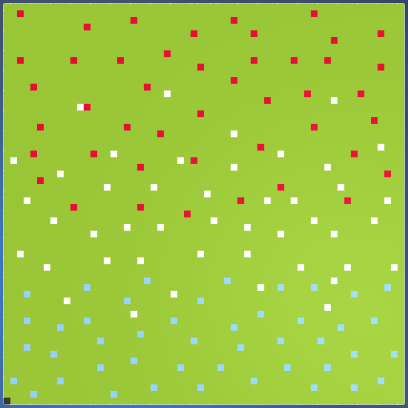

The picture on the top illustrates a world after 365 time steps (a year) without a high estate tax on a medium scale. The wealth gap is large between the upper-class and the lower two classes. The picture on the bottom shows a small scale world after a year with a high estate tax. The wealth distribution is more even than on the smaller scale but again, there is still a gap. Additionally, there are still a small number of upper-class people.

Large Scale

On the largest scale, the model without a high estate tax exhibits the largest gap between the classes. The model with a high estate tax exhibits the most fair and even distribution of wealth. This means that by having a high estate tax we can have a society with an equal distribution of wealth on the largest scale.